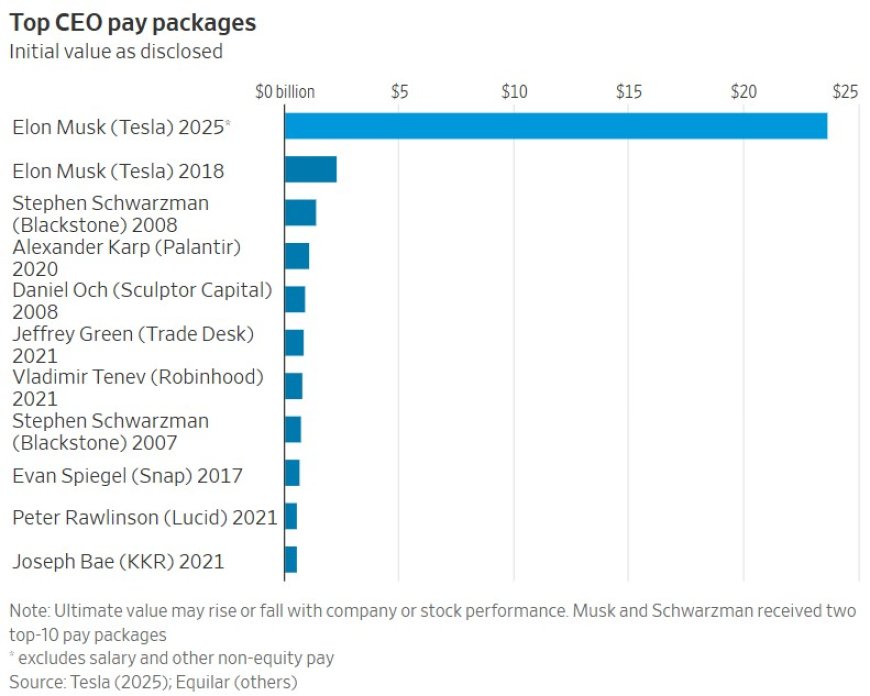

Elon Musk Gets $23.7 Billion Stock Award From Tesla to Stay Focused

Electric-vehicle maker’s board grants 96 million new shares to its chief executive

Tesla TSLA 2.41%increase; green up pointing triangle took a “first step” to keep its leader Elon Musk focused on the struggling electric-vehicle maker, awarding the world’s richest man one of the biggest-ever stock awards to stick around for at least two years.

Tesla’s board approved a stock award for Musk that it tentatively valued at $23.7 billion, which he can claim in two years unless a court rescues his prior, larger stock-option grant. Musk has run Tesla without a pay package since his $50 billion option award was tossed by a court in 2024.

The electric-vehicle maker said its “interim award” of 96 million shares will vest as long as Musk remains on the job as chief executive or under another executive title heading product development or operations, according to a securities filing. It described the award as a “first step, good faith payment” to keep the world’s richest man engaged.

Tesla’s business has been in a funk this year amid falling vehicle sales as investors fret about how much time Musk is spending on other pursuits. After stepping back from his work as a White House adviser in late May, he has overseen the launch of Tesla’s robotaxi service. But he also has been rounding up billions in funding for money-losing xAI while SpaceX overcame a Starship rocket explosion in June to successfully send four astronauts to the International Space Station.

Musk has said that his willingness to run Tesla for the next five years is contingent on his ability to have greater control of the company. In a video interview at the Qatar Economic Forum in May, Musk said he wanted enough voting control that he couldn’t be “ousted by activist investors.”

“It’s not a money thing. It’s a reasonable control thing over the future of the company,” he said. “Especially if we’re building millions—potentially billions—of humanoid robots. I can’t be sitting there and wondering if I’m going to be tossed out for political reasons by activists. That would be unacceptable. That’s all that matters.”

A Delaware judge has twice struck down Musk’s 2018 pay package, including after a decision that followed a shareholder vote in 2024 that approved the compensation for a second time. The ruling has loomed over Tesla’s board as it has sought to keep Musk focused on Tesla amid other companies he oversees and a brief tenure in Washington, D.C., leading a cost-cutting effort under the Trump administration.

The stock traded higher Monday on the news. The company currently sports a market valuation of roughly $970 billion. Musk owned about 20% of the company’s shares as of Dec. 31, the company said in a late-April securities filing.

Tesla said its latest pay package would have been valued around $23.7 billion based on the company’s closing stock price on Friday, had approvals been obtained. The underlying shares were worth about $29.1 billion at Friday’s closing price, but Musk would have to pay $2.2 billion at vesting under the award’s terms. The company reduced the valuation by about $3 billion to reflect restrictions on the award, including the two-year vesting period.

Musk won’t receive the new Tesla award if the company wins a case before the Delaware Supreme Court and he is subsequently able to exercise $50 billion in options he received in 2018. The company is appealing an earlier Chancery Court decision invalidating that pay package.

“We are confident that this award will incentivize Elon to remain at Tesla,” board members Robyn Denholm and Kathleen Wilson-Thompson said in a statement on X, the social-media platform owned by Musk.

Tesla also hinted at more developments to come in Musk’s pay. In a letter to shareholders, the two directors, serving as a special board committee, said it “continues our work to address a longer-term CEO compensation strategy,” with plans to put it to a shareholder vote at the company’s Nov. 6 annual meeting.

The directors acknowledged that Musk’s time is divided between several companies and Tesla needed to provide him with an incentive to stay focused on the EV maker.

“To be clear, losing Elon would not only mean the loss of his talents but also the loss of a leader who is a magnet for hiring and retaining talent at Tesla,” the directors wrote.

The letter pointed to the company’s market-capitalization gains following Musk’s 2018 pay package, which it said “resulted in a $2.3 billion stock-based compensation charge to Tesla but brought about $735 billion of increased market capitalization.”

In its decision invalidating that pay package, the Delaware Chancery Court called Tesla’s process for devising and awarding it “deeply flawed,” citing close ties between Musk and company directors and other factors. It isn’t clear when the Delaware Supreme Court might decide Tesla’s appeal, and no hearing date has been set.

At the company’s tentative valuation, the new stock award would outstrip most or all pay packages for CEOs at publicly traded companies, retaining the distinction Musk gained in 2018 as the highest-paid chief on record.

Equity awards can grow to be significantly larger than their initial valuations, in large part based on changes in the underlying share price, drawing a contrast between the cost of the compensation to the company and the value of what the executive eventually receives.

Tesla said it wouldn’t record compensation expense for the award on its financial statements, arguing that it doesn’t expect the conditions will be found “probable of being met.” It said it would re-evaluate at least quarterly and recognize the expense if it concludes the award is likely to be met, including after the two-year vesting period.

Source: https://www.wsj.com/

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0